driven brands stock forecast

The Score for DRVN is 80 which is 60 above its historic median score of 50 and infers lower risk than normal. Stock Market Prediction US.

Saas Kpi Dashboard Excel Kpi Report Template Dynamic Reporting Dashboard Performance Tracking Report Kpi Dashboard Excel Kpi Dashboard Interactive Charts

NASDAQ Stock Exchange Auto Truck Dealerships Consumer Cyclical Watchlist.

. About the Driven Brands Holdings Inc stock forecast. Estimated return represents the projected annual return you might expect after purchasing shares in the company and holding them over the default time horizon of. Driven Brands Holdings Inc quote is equal to 33410 USD at 2021-12-23.

Driven Brands has a 1 year low of 2462 and a 1 year high of 3462. Considering analysts have assigned the stock a price target range of 2700-4800 as the low and high respectively we find the trailing 12-month average consensus price target to be 3913. Stock Price Forecast The 7 analysts offering 12-month price forecasts for Driven Brands Holdings Inc have a median target of 4000 with a high estimate of.

Driven Brands Holdings Inc is an automotive services company. As of 2022 July 06 Wednesday current price of DRVN stock is 28240 and our data indicates that the asset price has been in a downtrend for the past 1 year or since its inception. Driven Brands Holdings Inc.

Stock Forecast NASDAQDRVN BUY. Is 2636 for 2027 Jun. The current Driven Brands Holdings DRVN share price is 3018.

Driven Brands stock forecast According to Market Beat analysts average target price is 3575 for DRVN stock which is 25 percent above its current price. Find out the current price target and stock forecast for Driven Brands Holdings DRVN. Is 2993 for 2023 Jun.

Diversify your portfolio with guidance from investment professionals. Discover Which Investments Align with Your Financial Goals. Is 2954 and for 2031 Jun.

Will Driven Brands Holdings Stock Go Up Next Year. Ad Financial Security is Attainable. 2668 - 2792 Driven Brands Holdings 2780 027 098 General Chart News Analysis Financials Technical Forum Technical Analysis.

DRVN Driven Brands Holdingss current Earnings Per Share EPS is 038. Driven Brands Stock Performance. Is 2833 for 2026 Jun.

Analysis of Driven Brands Polynomial Regression Driven Brands polinomial regression implements a single variable polynomial regression model using the daily prices as t. See Driven Brands Holdings Inc. Driven Brands Holdings Inc.

Check out these 3 market-beating stocks. Driven Brands Price Performance. The company has a 50 day moving average price of.

With a 5-year investment the revenue is expected to be around 5981. Shares of DRVN opened at 3018 on Monday. Stock Forecast Tomorrow World Stock Markets ETF Market Prediction ETF Forecast Tomorrow Cryptocurrency Prediction Forex Market Prediction Currency.

USD 2639 111 439. Driven Brands Stock Forecast - Naive Prediction. Our system considers the available information about the company and then compares it to all the other stocks we have data on to get a percentile-ranked value.

New target price is 34 above last closing price of US2939. DRVN - USA Stock. Driven Brands Holdings Inc.

On average analysts forecast that DRVNs EPS will be 111 for 2022 with the lowest EPS forecast at 108 and the highest EPS forecast at 120. Earnings is forecast to grow by 165 in the next year. Driven Brands Holdings Inc.

DRVN stock analyst estimates including earnings and revenue EPS upgrades and downgrades. DRVN is currently trading in the 70-80 percentile range relative to its historical Stock Score levels. The company has a debt-to-equity ratio of 141 a current ratio of 127 and a quick ratio of 115.

Performance History Market Value Charts Correlation Forecast. Driven Stock Forecast is based on your current time horizon. Your current 100 investment may be up to 15981 in 2026.

DRVN stock opened at 3018 on Monday. May 27 Price target decreased to US3938 Down from US4275 the current price target is an average from 7 analysts. NASDAQDRVN opened at 3018 on Monday.

DRVN share price prediction for 2022 2023 2024 2025 2026 and 2027. Driven Brands Holdings stock price has been showing a declining tendency so we believe that similar market segments were. Find a Dedicated Financial Advisor Now.

Based on our forecasts a long-term increase is expected the DRVN stock price prognosis for 2026-12-21 is 53392 USD. Stock is down 08 over the past year. Forecast for 2022 Jul.

The firm has a 50 day moving average of 2806 and a. DRVN one year forecast. Wall Street Analysts Predict a 55 Upside in Driven Brands Holdings Inc.

Driven Brands Holdings Polynomial Regression. 9 hours agoDriven Brands Stock Performance. NASDAQDRVNs beta value is holding at 0 while the average true range ATR indicator is currently reading 106.

The company has a 50 day. Driven Brands Holdings Inc DRVN gets an Overall Rank of 74 which is an above average rank under InvestorsObservers stock ranking system. While the effectiveness of this highly sought-after metric is questi.

According to the issued ratings of 3 analysts in the last year the consensus rating for Driven Brands stock is Buy based on the current 3 buy ratings for DRVN. Revenue is forecast to grow by 24 in a year. The average twelve-month price prediction for Driven Brands is 4033 with a high price target of 4100 and a low price target of 4000.

Driven Brands Holdings stock monthly and. Heres What You Should Know The average of price targets set by Wall Street analysts indicates a potential upside of 549 in Driven Brands Holdings Inc. Report 2956 376 Volume.

Stock Driven Brands Holdings. Among the nine analysts tracking DRVN.

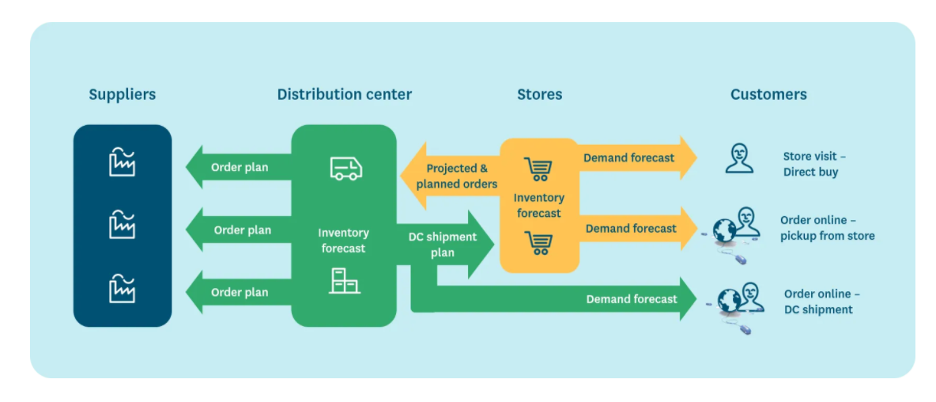

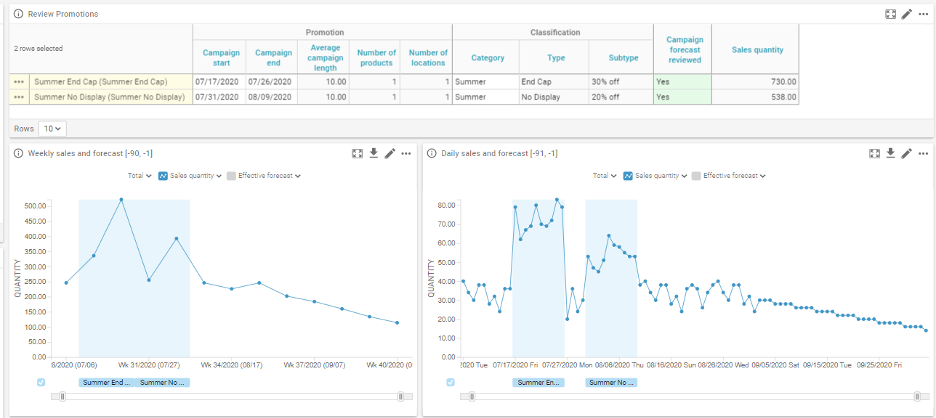

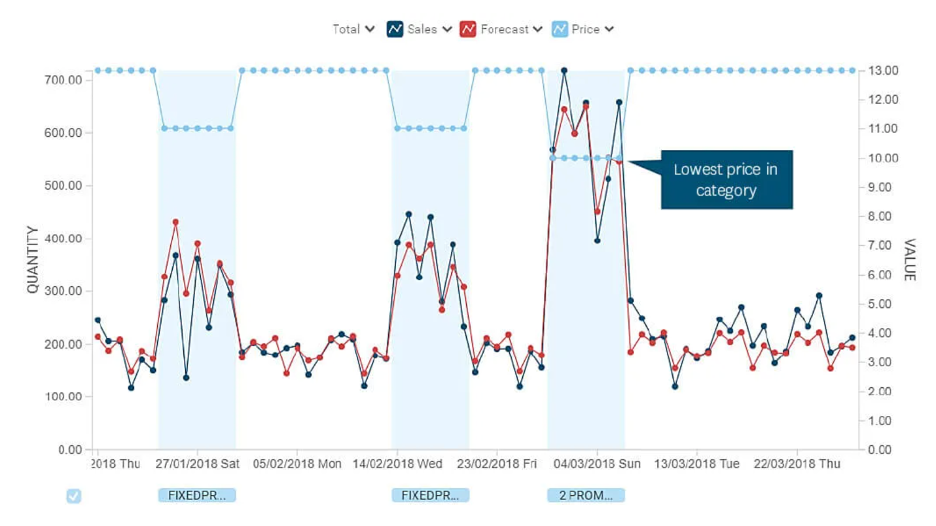

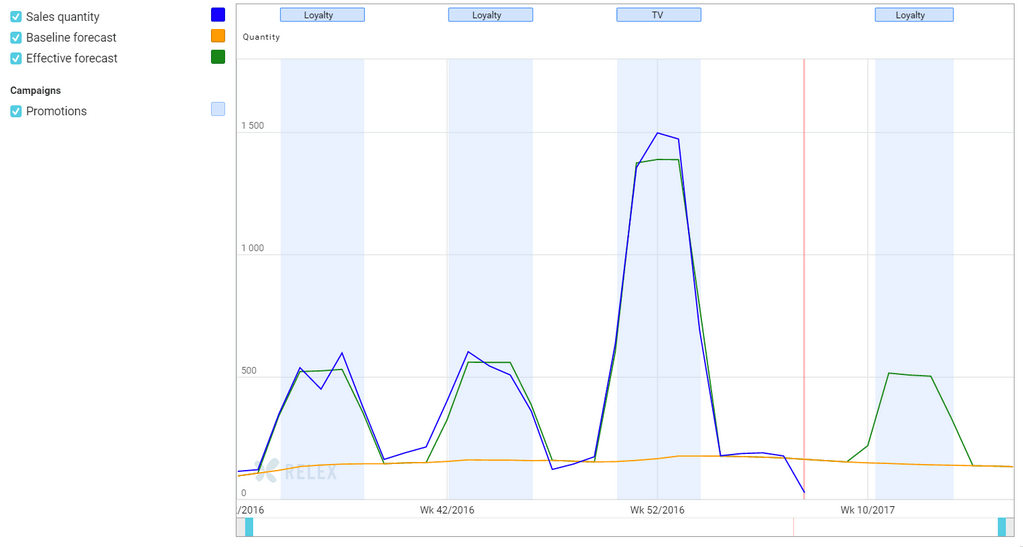

4 Keys To Better Retail Promotion Forecasting And Replenishment Relex Solutions

4 Keys To Better Retail Promotion Forecasting And Replenishment Relex Solutions

Electro Digital World Xiaomi Fitness Tracker Touch Screen

Automated Barriers And Bollards Market To Reach Usd 1 93 Billion At Cagr 2 98 By 2026 Rep Automatic Number Plate Recognition Marketing Technology Automation

Bio Based Polyethylene Terephthalate Market Share Size Report 2023 Pet Market Marketing Share Market

Elaine Maslin On Twitter Gas Supply Public Relations Oil And Gas

Flowalgo Is The Future Of Trading Swing Trading Stock Market Tutorial

4 Keys To Better Retail Promotion Forecasting And Replenishment Relex Solutions

Alloy Planning Pos Based Forecasting Planning

Naked Brand Group Nakd Stock Forecast New Year New Me

Gen Z Goes To The Gram For New Products Brand Engagement Emarketer Trends Forecasts Statistics Gen Z Research Companies Asset Management

Measuring Forecast Accuracy The Complete Guide Relex Solutions

Airport Security Market Size Share Forecast Report 2022 2028 Airport Security Marketing Perimeter Security

Chile A Long Narrow Country Stretching Along South America S Western Edge With More Than 6000km Of Pacific Ocean Coastline The E Aluminium Chile Aluminum Foil

3 Critical Steps For Leaders To Build Successful Data Driven Companies Financial Accounting Web Application Development Business Data